When exploring cost-efficient and diversified ways to grow your wealth, Exchange-Traded Funds (ETFs) and index funds often come into focus. Both offer access to a variety of securities, yet each operates uniquely. Knowing their differences can help you decide which aligns best with your financial aspirations.

In this article, we’ll delve into the core aspects of ETFs and index funds and highlight their distinctions to help you make the right choice for your investment portfolio.

What Are ETFs?

An Exchange-Traded Fund (ETF) is a collection of investments that mirror the performance of a particular index, commodity, or asset. Unlike mutual funds, ETFs trade on stock exchanges, with prices fluctuating throughout the day. This allows investors to buy a diversified portfolio of assets, such as stocks, bonds, or commodities, in one transaction.

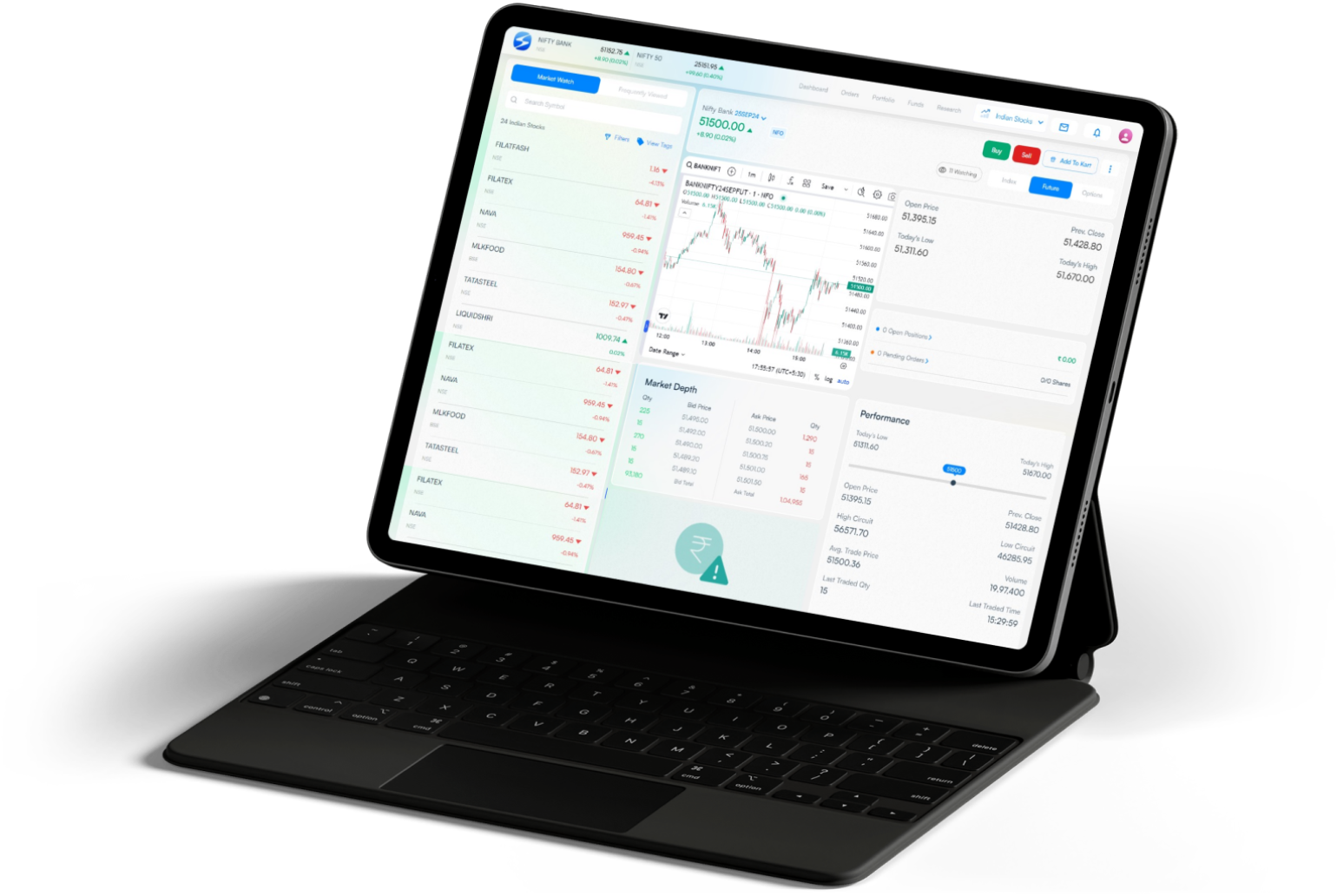

Using an efficient trading app streamlines ETF investing, providing real-time updates, market analysis, and seamless trade execution. With a reliable platform, you can monitor price trends and adjust your investments with ease.

ETFs in the Stock Market

In the stock market, ETFs enable investors to gain exposure to multiple stocks or sectors simultaneously. For instance, an ETF tracking a benchmark index simplifies diversification, letting investors capture the overall market movement without purchasing individual stocks.

What Are Index Funds?

An index fund is a passive investment vehicle that mirrors the performance of a specific market index, like a stock exchange benchmark. These funds aim to replicate the returns of the chosen index, making them an ideal option for those seeking long-term growth without active management.

Key Features of Index Funds

- Cost-Effective: Index funds are known for their minimal expense ratios due to their passive management approach.

- Steady Growth Potential: They aim for consistent returns by closely tracking the performance of the market index.

- Accessible Investments: Many platforms allow investors to start with a demat account, simplifying the process of acquiring these funds.

ETF vs. Index Fund: Key Differences

Although ETFs and index funds share similarities in tracking an index, they differ in structure and functionality.

|

Feature |

ETF |

Index Fund |

|

Trading |

Traded during market hours |

Priced once daily at closing |

|

Minimum Investment |

No minimum required |

Often has a minimum investment amount |

|

Fees |

Lower expense ratios but brokerage costs |

Generally low fees without trading costs |

|

Tax Efficiency |

Highly tax-efficient |

Less tax-efficient |

|

Liquidity |

High, trades like stocks |

Lower, restricted to end-of-day trading |

|

Flexibility |

Real-time trading options |

Passive, hands-off investment |

Who Should Consider Index Funds?

Index funds are tailored for investors who prefer simplicity and long-term strategies. They are suitable for:

- Passive Investors: Those aiming for growth over an extended period without monitoring daily fluctuations.

- Low-Risk Investors: Individuals who favor predictable returns aligned with market performance.

- Cost-Conscious Investors: Those seeking investments with minimal fees and operational costs.

Risk and Rewards of ETFs and Index Funds

Risks

- ETFs: As ETFs are traded like stocks, their prices can fluctuate significantly throughout the day, introducing short-term volatility. However, they are often more tax-efficient.

- Index Funds: While less volatile, they lack the tax benefits associated with ETFs.

Rewards

Both options offer broad diversification and low-cost access to various asset classes. ETFs provide flexibility through intraday trading, while index funds excel in offering stable, long-term growth with less management effort.

ETF vs. Index Fund: Which Is Better for You?

Choosing between ETFs and index funds depends on your investment approach.

- ETFs: Ideal for active traders who value flexibility and want to capitalize on intraday price changes. They are also suited for those who appreciate tax advantages and lower initial investments.

- Index Funds: Perfect for those focused on long-term growth with minimal effort. These funds align with investors who prioritize simplicity over daily market tracking.

If you are starting small, ETFs might be more appealing as they typically don’t have minimum investment requirements. For those seeking consistency, index funds offer an excellent option.

Where to Invest in ETFs and Index Funds

To begin, open a demat account, which acts as a secure repository for your investments. ETFs can be bought through brokerage platforms or online trading platforms that provide access to stock exchanges. Reliable apps make it convenient to execute trades, monitor your portfolio, and analyze market trends.

Index funds, on the other hand, can be purchased directly from fund providers or through brokers. Automated investment plans offered by these platforms are an added advantage for passive investors.

Are ETFs Riskier Than Index Funds?

While both are relatively low-risk compared to individual stocks, ETFs may appear riskier due to their intraday price fluctuations. However, their tax-efficient structure and real-time trading capability often outweigh the perceived risks for active investors. Index funds, with their end-of-day pricing, offer more stability for conservative investors.

Conclusion

Deciding between ETFs and index funds depends on your investment objectives and preferred style. If you prioritize flexibility, intraday trading, and exposure to specific sectors, ETFs may be your best choice. For a hands-off approach focusing on long-term growth, index funds are a better fit.

To get started, download a trusted investment app or trading app that simplifies the investment process, provides tools for analysis, and offers secure transactions. Both ETFs and index funds have unique advantages, and understanding their features ensures you select the option that aligns with your financial goals.

Leave a Reply